Strategy

What is the R&D Tax Credit?

The R&D Tax Credit, first enacted in 1981, has been one of the most valuable credits leveraged by companies both in the U.S. and around the world. The R&D credit yields billions of dollars in federal and state benefits every year to companies engaged in qualifying research. Thousands of companies take advantage of the credit across numerous industries. Some of the common industries that qualify for the R&D tax credit include, but are not limited to:

Service Features

Assess

If we fail to find viable value for your business during the first phase of the Study process, you pay nothing.

Implement

We know our clients are busy and pride ourselves on ensuring that each project is executed with both our clients’ time and schedules as key priorities.

Deliver

On completion of our work, in addition to receiving final credit calculations each of our clients receives a detailed summary of our analysis; frequently providing additional helpful operational or strategic insights.

A Comprehensive Approach to

Complex Development Work

- Identify all relevant R&D activities through holistic activity assessment

- Prepare detailed technical project reports to substantiate our clients’ R&D activities

- Identify all qualified R&D expenses attributable to our clients’ development efforts

- Prepare calculations of federal and state credits

- Deliver a final R&D Tax Credit Study report containing technical project reports, tax credit calculations, and supporting information

- Provide expertise and perspective to our clients about the R&D credit and how they may maximize the credit benefit.

Frequently Asked Questions?

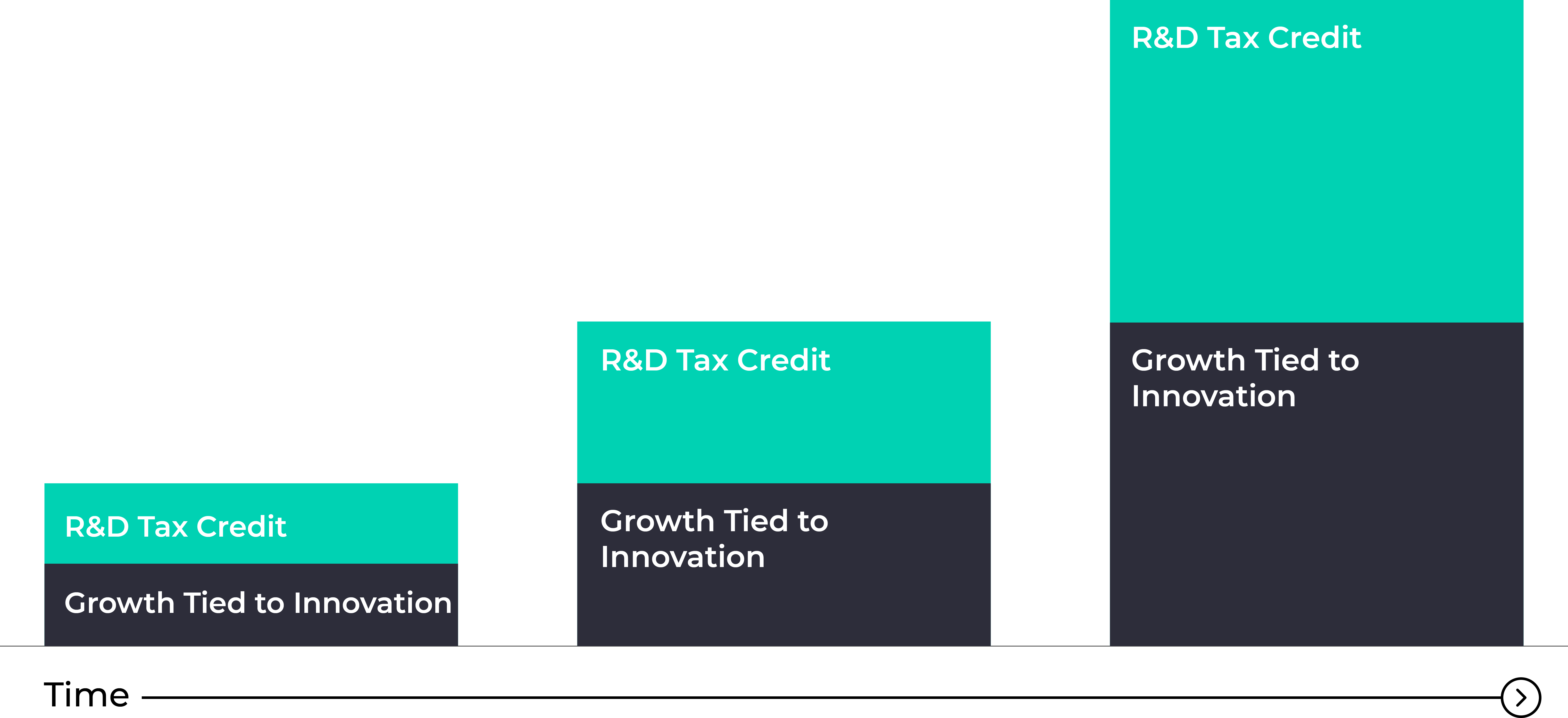

We use R&D tax credits to help you reclaim research and development costs By leveraging the power of R&D tax credits, our clients are able to reclaim costs and put those resources back to work driving growth and improving overall financial performance

In general, activities qualify if they meet each element of a “four-part test” and aren’t excluded.

Four-part Test

- Qualified purpose. The purpose of the activity is to improve the functionality, performance, reliability, or quality of a product, process, software, technique, invention or formula that is intended to be used in the taxpayer’s business or held for sale, lease or license (component).

- Technological uncertainty. The taxpayer encounters uncertainty regarding whether it can or how it should develop the component, or regarding the component’s appropriate design.

- Process of experimentation. To eliminate the uncertainty, the taxpayer evaluates alternatives through modeling, simulation, systematic trial and error, or other methods.

- Technological in nature. The success or failure of the evaluative process is determined by the principles of engineering, physics, chemistry, biology, computer science, or similar natural or “hard” science, as opposed to principles of, e.g., economics, social sciences generally.

In general, any company—in any industry and of any size—that invests in activities of the kind outlined in this FAQ can benefit if in the course of carrying on a U.S. trade or business the company paid, pays or expects to pay:

- Regular federal income tax;

- A similar state tax in one of the more than 40 U.S. states that provide for incentives for R&D and R&D-related investments; or

- In certain circumstances outlined below, federal payroll tax; or

- Similar taxes in one of the more than 35 non-U.S. countries that also provide for such incentives.

Industry generally doesn’t matter: Although most R&D credits are claimed by companies in manufacturing (usually 60-70% of total credits claimed), information (15-20%), professional, scientific, and technical services (10-15%), wholesale and retail (5-10%), and financial and insurance (5%), millions of credits are claimed each year by companies in other industries, including natural resources, like mining and oil-and-gas; services, e.g., health, entertainment, administrative, and hospitality; architecture and construction; real estate, rental, and leasing; transportation and warehousing; agriculture; forestry; fishing and hunting. And size never matters: Businesses with $0 in sales and one employee can have significant R&D credits.

- Yes.

- Most states offer a credit for expenditures to attempt to develop or improve a product, process, or software, and most adopt or follow rules similar to those of the federal R&D credit.

- Some states require taxpayers to file an application other than just the tax return on which the credit is claimed to be eligible for their credits. Some also limit their credit to certain industries or the amount of credits that will be allowed each year.

- Some states require taxpayers to file an application other than just the tax return on which the credit is claimed to be eligible for their credits. Some also limit their credit to certain industries or the amount of credits that will be allowed each year.

- The credit is claimed on a timely-filed (including extension) federal income tax return for the year in which the qualified expenses were incurred. The credit may also be claimed by amending a previously-filed return on or before the statute of limitations date to report credits related to expenses incurred during that period. The statute of limitations generally grants three years after the original deadline or filing date (whichever is earlier) to amend returns.

- Reduces net cost of product and process development or improvement costs By receiving money back for eligible R&D activities, final cost of development for a given project are reduced substantially.

- Immediately reduce current tax year liability When claiming the credit on a current-year tax filing, any tax owed is immediately reduced by the amount of the credit on a 1:1 basis allowing your business to benefit from the credit immediately.

- Claim retroactively to receive refund for prior years Our experts can conduct an analysis on any open tax year to calculate the credit your business is entitled to for those activities. Your business would then receive a refund for that amount after amending the original federal or state(s) tax filing.

- Available to both established businesses and start-ups alike Your business need not be paying income tax to benefit today from the R&D tax credit. Start-ups and other small businesses may be eligible to apply the R&D credit to offset up to $250,000 in annual payroll taxes.

- Taxable wages for employees who perform or directly supervise or support qualified activities.

- Cost of supplies used in qualified activities, including extraordinary utilities, excluding capital items or general administrative supplies.

- 65%-100% of contract research expenses for qualified activities, provided the taxpayer retain substantial rights to the activity’s results and must pay the contractor whether it succeeds or fails.

- Rental or lease costs of computers used in qualified activities, e.g., payments to cloud service providers (CSPs) for the cost of renting server space to develop or improve a component.

- You may still be able to benefit currently from your R&D credits.

- Startup taxpayers in certain circumstances may offset up to $250,000 of their federal payroll tax liability using R&D credits.

- Many states provide credits that are refundable, i.e., states pay the amount of the credit as a refund whether you’re paying income tax now or not.

- And if you don’t owe income taxes this year but paid income taxes last year, you can carry your credit back to the preceding year to offset some or all of that year’s tax liability.

- If you don’t owe income taxes this year or last year, you might not be able to benefit from the credit this year. You still can carry it forward to future years, up to 20 years forward for federal and some state R&D credits, and even indefinitely forward for other states, e.g., California.

- Identify and gather support for the credit to which you’re legally entitled. Report the credit on a timely-filed (including extensions) federal tax return using Form 6765. If the entity reporting the credit is a pass-through, the partner or shareholder will report their share of credits via Form K-1 on their 1040 returns to monetize the credit.

- Tax years that are open to amendment under relevant statutes of limitations may be amended to include credits. This period is generally three years from the unextended due date or the return filing date, whichever is later.