Backdrop

The ability for U.S. based innovators to maximize the efficiency of their investments into R&D related areas of their operations (e.g. product development, materials research, production design, testing, etc.) is critical to maintaining an environment that attracts these innovators to the U.S., enables them to attract and keep top technical talent, and ensures that the U.S. remains at the forefront of so many of the world’s technological and scientific focus areas. R&D related tax incentives can be found in upwards of 90 nations around the world today; all aimed at either retaining current participants and/or attracting new innovators from around the world.

For decades the U.S. has taken a comprehensive approach to essentially ‘de-risking’ investment made by innovators located within her borders by providing them with a variety of fiscal levers that reduce the net cost of research and development (R&D) in the form of tax deductions and credits. As the focus on innovation has increased worldwide and become more competitive, so too has the focus on the effectiveness of the U.S. deductions and credits in place to protect and grow our status as a world leader in innovation. And the findings against this increasingly competitive backdrop now appear to be at least somewhat mixed as the recent change to the deducibility of R&D expenses has now rippled through its’ first full tax filing season.

Prior to the 2022 tax year, companies could choose to immediately deduct the full value of their R&D investments when they file taxes each year. However, due to a change made by the 2017 tax law, beginning with the 2022 tax year companies were required to spread these deductions over a 5-year period.

Throughout the year we’ve seen several legislative proposals focused either on directly reversing the expense amortization requirement (S.866) or seeking to offset it with increases to either the R&D Tax Credit amount (H.R. 5056) or to the caps currently in place on eligibility for other innovation related tax benefits (H.R. 368).

Comprehensive Assessment

H.R. 5056

H.R. 5056, dubbed the Fostering Innovation and Research to Strengthen Tomorrow Act, is the most recent proposal and seeks to substantially increase the value of the federal R&D Tax Credit for U.S. based innovators by proposing a comprehensive set of changes to the current statute:

- A doubling of the benefit rate (from current 20% to 40%) of the tax credit for increasing research expenses.

xx - A doubling of the benefit rate (from current 14% to 28%) for the alternative simplified research tax credit.

XX - Increases the credit rate for taxpayers with no research expenses during the three years prior to the tax year for which a credit is being sought (from current 6% to a floating amount defined as 50% of the rate in effect under a ‘regular credit’ calculation methodology).

XX - Substantially increases the Qualified Small Business Gross Receipts Threshold from the current $5,000,000 average gross receipts cap on eligibility to $25,000,000 (by removing the fixed $5mm standard and instead referencing to the cap to the 448 gross receipts test cap at the given time).

If passed would be applicable to tax years beginning after December 31, 2023.

The Bill is sponsored by Representative Claudia Tenney (R-NY;24) and, as of November 22, 2023, is co-sponsored by Reps. Vern Buchanan (R-FL; 16), Randy Feenstra (R-IA; 4), and Carol Miller (R-WV; 1).

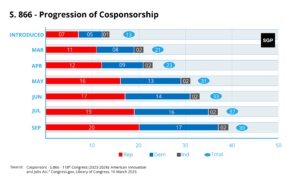

S. 866

S.866 – American Innovation and Jobs Act – revises and expands the deductibility of research and experimental expenditures to allow immediate expensing of these expenditures. It also allows the amortization over a period of at least 60 months (five years) of certain other types of research and experimental expenditures not treated as expenses.

It also increases the maximum amount eligible for the R&D tax credit for new and small businesses and increases to 20% the rate of the R&D tax credit for business startups.

Please find our full in-depth summary of Senate Bill S.866 located here.

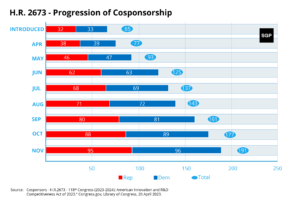

H.R. 2673

H.R. 2673 – American Innovation and R&D Competitiveness Act of 2023 – eliminates the five-year amortization requirement for research and experimental expenditures, essentially restoring the pre 2022TY expensing of these expenditures in the taxable years in which they are incurred.

Please contact us to request a free copy of our comprehensive policy brief for House Bill H.R. 2673.

H.R. 368

H.R. 368 – The American Innovation Act of 2023 – revises the tax treatment of business start-up or organizational expenditures. Specifically, it allows an election to deduct such expenditures in an amount equal to the lesser of the aggregate amount of such expenditures incurred by an active trade of business, or $20,000, reduced by the amount by which such aggregate amount exceeds $120,000. The remaining amount of such expenditures shall be amortized over the 180 month period after the trade or business begins.

The bill also revises the tax treatment of partnership syndication fees and start-up net operating losses and tax credits after an ownership change.

Please find our full in-depth summary of House Bill H.R. 368 located here.

Is There Momentum One Direction v. Another?

‘Yes’ and ‘No’.

‘Yes’ Because:

Both S.866 and H.R. 2673 have seen a sustained progression in co-sponsorship growth (particularly H.R. 2673) and maintained bipartisan support.

S. 866

H.R. 2673

As we prepare to head into an election year, it is also important to point out that although Congress does tend to propose less new legislation in those years (much less in fact), it also tends to pass more legislation (much more in fact)[1].

‘No’ Because:

H.R. 5056

As noted above, H.R. 5056 was first introduced in late July with 2 co-sponsors but has seen scant additional cosponorship support, adding only a single cosponsor after its introduction (on August 22, ’23; Rep. Miller, R-WV.) While the substance of the bill may be exciting for R&D involved taxpayers, there does not appear to be any substantive support within the House of Representatives for this specific piece of legislation at this time.

H.R. 368

H.R. 368 has no cosponsors.

From a technical analysis point of view the extent of the value that legislative cosponorship as a signal or metric for evaluating congressional support for a bill remains uncertain as well. While it is often cited by policy analysts and journalists when reporting on the status or prospective way forward for pending legislation, some studies have called into question the potency of cosponorship assessment as a signal as well[2].

Be Heard

Want your thoughts or perspective to be heard by those involved in these bills?

You may reach out directly to the offices of the Sponsors for each bill referenced in this article using the links below:

S. 866: Senator Margaret Wood Hassan

H.R. 2673: Representative Ron Estes

H.R. 5056: Representative Claudia Tenney

H.R. 368: Representative Vern Buchanan

You can also reach out to us directly. We are aggregating the comments and feedback we receive and will be sharing a summary of those perspectives with Congress as well.

[1] Ingraham, Christopher. “Believe it or not, Congress gets more done in election years.” The Washington Post, May, 2014. https://www.washingtonpost.com/news/wonk/wp/2014/05/01/believe-it-or-not-congress-gets-more-done-in-election-years/

[2] Wilson, Rick K., and Cheryl D. Young. “Cosponsorship in the U. S. Congress.” Legislative Studies Quarterly, vol. 22, no. 1, 1997, pp. 25–43. JSTOR, https://doi.org/10.2307/440289. Accessed 24 Nov. 2023.