Key Takeaways

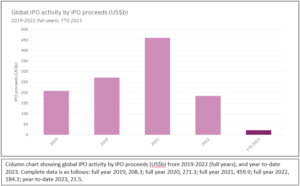

- In the first quarter of 2023 global IPO volumes fell 8%, with proceeds down by 61% YOY

- There was only one mega IPO, stemming from Middle East, with US$2.5b in proceeds

- Asia-Pacific dominated the quarter, accounting for 59% of global IPO deals.

With only one quarter into 2023, it was more of the same for the stuttering global IPO market. With a total of 299 IPOs raising US$21.5b, an 8% and 61% decrease year-over-year (YOY), respectively, Q1 was another down period amid interest rate rises, a lukewarm stock market, entrenched inflation, and unexpected global banking industry turbulence. Despite this ongoing uncertainty around the economic and geopolitical environment, the IPO pipeline continues to build up and hope remains for a turnaround later this year. These and other findings were published in the EY Global IPO Trends Q1 2023.

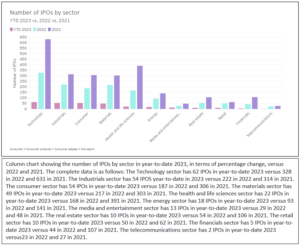

Technology companies, which have been a mainstay of IPO activity in recent years, experienced some sharp declines in valuations, and the turmoil in the crypto markets and global banking industry has not helped. While technology continued to lead in IPO volume, four of the top 10 listings in Q1 2023 were in the energy sector.

High liquidation and poor post-listing performance of de-SPACs dampened investors’ appetite for new IPOs. This quarter, SPAC IPO activity was at one of its lowest levels in recent years – it hit a six-year low in terms of volume, with proceeds also down to levels not seen since 2016. As market conditions remain challenging and many promoters of SPACs listed in early 2021 need to complete or unwind their transactions, SPAC IPO activity is likely to be muted in the near term.

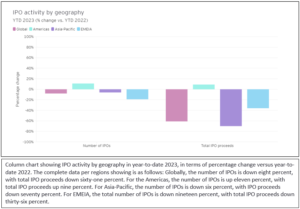

Overall regional performance: any early euphoria felt disappeared by quarter end

The Americas IPO activity was in line with Q1 2022, but it was well below the levels seen in comparable periods over the last decade, finishing out this quarter with 40 deals and US$2.6b in proceeds, up 11% and up 9%, respectively, YOY. On US exchanges, there were 31 deals, eight of which were in excess of US$50m. Meanwhile, Canada saw its biggest IPO since May 2022, raising over US$100m in proceeds. Even though IPO activity levels have been on the lighter side, we have begun to see some early positive developments in the areas of inflation, interest rates, valuations and market volatility, which could set the stage for a potential recovery in the Americas IPO market.

Even though the Asia-Pacific IPO market accounted for 59% of global IPO deals, its activity declined 6% by number and plummeted 70% by proceeds, respectively, YOY, recording only 175 deals and US$12.7b in proceeds for the quarter. Despite the lifting of almost all its pandemic control measures earlier this year, the Mainland China market was a bit quieter than usual, but it is on a healthy projected track and still accounts for more than 40% of all global IPO proceeds. Hong Kong, also usually a powerhouse for new listings, was uncharacteristically quiet. Overall, Asia-Pacific, took a “wait and see” attitude, as investors kept their powder dry and looked for further indicators of market recovery.

As many companies withdrew or postponed their IPO filings due to market conditions, EMEIA IPO activity fell by 19% and 36% by number and proceeds, respectively, YOY, recording 84 IPOs raising US$6.2b for Q1. India as a region had the greatest drop in proceeds for EMEIA, with a sharp decline of 83%, even though it had a 50% increase in the number of listings. Globally, this quarter, the Middle East was also the only region with a mega IPO. Despite positive economic indicators, sentiment remains cautious, with investors being selective in a buyers’ market, seeking profitable and sustainable business cases.

Q2 2023 outlook: a glimmer of hope

Despite the unforgiving economic and geopolitical backdrop, there is light on the horizon, with peaking inflation, energy prices softening, and the rebound of Mainland China’s economy. However, the backlog for IPOs is continuing to build as companies are holding out for the stock market to stabilize and rebound before listing.

In a highly unpredictable and persistent inflationary environment, investors who were previously oriented toward funding growth and potential are now more focused on the path to profitability and cash flows. Collaboration between governments, including cooperation and stock-connect programs, along with investor appetite for diversity, could also lead to a wave of dual listings and cross-border deals this year.

Businesses will need to navigate high-cost and reduced liquidity environment for a little longer. Once there is evidence of a more stable market with higher certainty, investor confidence should return, and prominent companies that have postponed IPO plans may restart, albeit at more modest valuations.

Paul Go, EY Global IPO Leader, says: “Amidst persistent macroeconomic and geopolitical uncertainty, exacerbated by stress in the global banking system, IPO windows are fleeting and funding conditions are getting tougher, with investors prioritizing value over growth.

IPO-bound companies need to focus on building sustainable businesses with strong fundamentals to be well-positioned in a volatile environment and meet the challenges and opportunities of going public.”

Source: EY