Access to funding is one of the most important aspects of starting and growing any successful small business. And being aware of all available avenues to gain these important resources is the first step in developing and executing on a winning funding strategy, particularly for those focused on developing new technologies.

The U.S. Small Business Administration (SBA) offers two of the more longstanding technology and innovation oriented funding options, both in the form of grant programs:

- The Small Business Innovation Research Program (‘SBIR’; circa ’82); and

- The Small Business Technology Transfer Program (‘STTR’; circa ’92).

Both share a mandate to facilitate small businesses seeking to explore and maximize their technology development and commercialization potential as well as a common three phase gate-oriented progress format. There are, however, some important differences that distinguish the two programs that are also important for prospective applicants to understand.

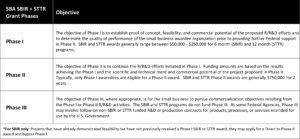

Phased Structure

The SBIR and STTR programs share a common three phase structure:

Eligibility

Only United States small businesses are eligible to participate in either SBIR or STTR programs. A small business, among other relevant criteria, must:

- Be organized for profit, with a place of business located within the United States;

- Be more than 50% owned and controlled by one or more individuals who are citizens or permanent resident aliens of the United States, or by other small business concerns that are each more than 50% owned and controlled by one or more individuals who are citizens of or permanent resident aliens of the United States; and

- May not have more than 500 employees (including affiliates).

For SBIR awards from agencies using the authority under 15 U.S.C. 638(dd)(1), an awardee may be owned and controlled by more than one VC, hedge fund, or private equity firm as long as no one such firm owns a majority of the stock.

Phase I awardees with multiple prior awards are required to meet the benchmark requirements for progress toward commercialization.

For STTR, the partnering nonprofit research institution must also meet certain eligibility criteria:

- Located in the United States; and

- Meet one of three definitions:

- Nonprofit college or university

- Domestic nonprofit research organization

- Federally funded R&D center (FFRDC)

STTR differs from SBIR in three important aspects:

- The small business awardee and its partnering institutions are required to establish an intellectual property agreement detailing the allocation of intellectual property rights and rights to carry out follow-on research, development, or commercialization activities

- The STTR program requires that the small business perform at least 40% of the R&D and a single partnering research institution perform at least 30% of the R&D

- The STTR program allows the Principal Investigator to be primarily employed by the partnering research institution.

For assistance with definitions and more detail please refer to the SBA’s official Guide to SBIR/STTR Program Eligibility, or contact us directly.

Award Funding Administration and Amounts

SBIR and STTR Participating Agencies

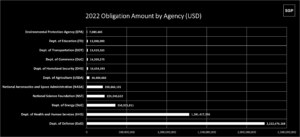

The SBA serves as the coordinator of the SBIR and STTR grant and contracting programs but does not directly fund either award to approved small businesses. Rather, funding for SBIR and STTR grants and contracts is provided at the agency level. Currently, eleven federal agencies participate in the SBIR program and five of those agencies also participate in the STTR program.

Each agency administers its own individual program within guidelines established by Congress. These agencies designate R&D topics in their solicitations and accept proposals from small businesses. Awards are made on a competitive basis after proposal evaluation.

Funding Amounts

Each year, participating Federal agencies with extramural research and development (R&D) budgets that exceed $100 million are required to allocate 3.2% (since FY2017) of this extramural R&D budget to fund small businesses through the SBIR program. Federal agencies with extramural R&D budgets that exceed $1 billion are required to reserve 0.45% (since FY2016) of this extramural R&D budget for the STTR program.

The following table reflects both the list of participating agencies for 2022 as well as their respective ‘obligation amounts’:

Please contact us to learn more about eligibility criteria, designated R&D focus areas, the application process, or administration related to SBA SBIR and STTR grant programs.